Your Money

In this final episode in our series ‘What You Should Know About…’ the most requested topic, YOUR MONEY! We give you ideas and insight on Automagic Budgeting, Investment Ideas, and your money mindset. This is an introduction to some ideas, strategies, and tactics to get you started and ready for the next level of money creation.

Related episodes on this topic are:

Continue Your Education With These Episodes

Each episode has more links & resources to help you start or enhance your journey.

28: Understanding Credit

Credit can be confusing, slow going and hard to get right. Having good credit can save you tens of thousands of dollars over your lifetime and give you access to opportunities for a better financial future. We want to help you with this and shed some light out how this machine works. On this episode, we talk about understanding credit, types of credit and using credit to your advantage.

Remember, With Great Credit Comes Great Responsibility!

17: Who’s Got My Money?

Who’s got my money? Do you understand how the banking system works? What type of awareness do you have about money? We talk about where your money really is, basics about money and some ideas on making your money work harder for you.

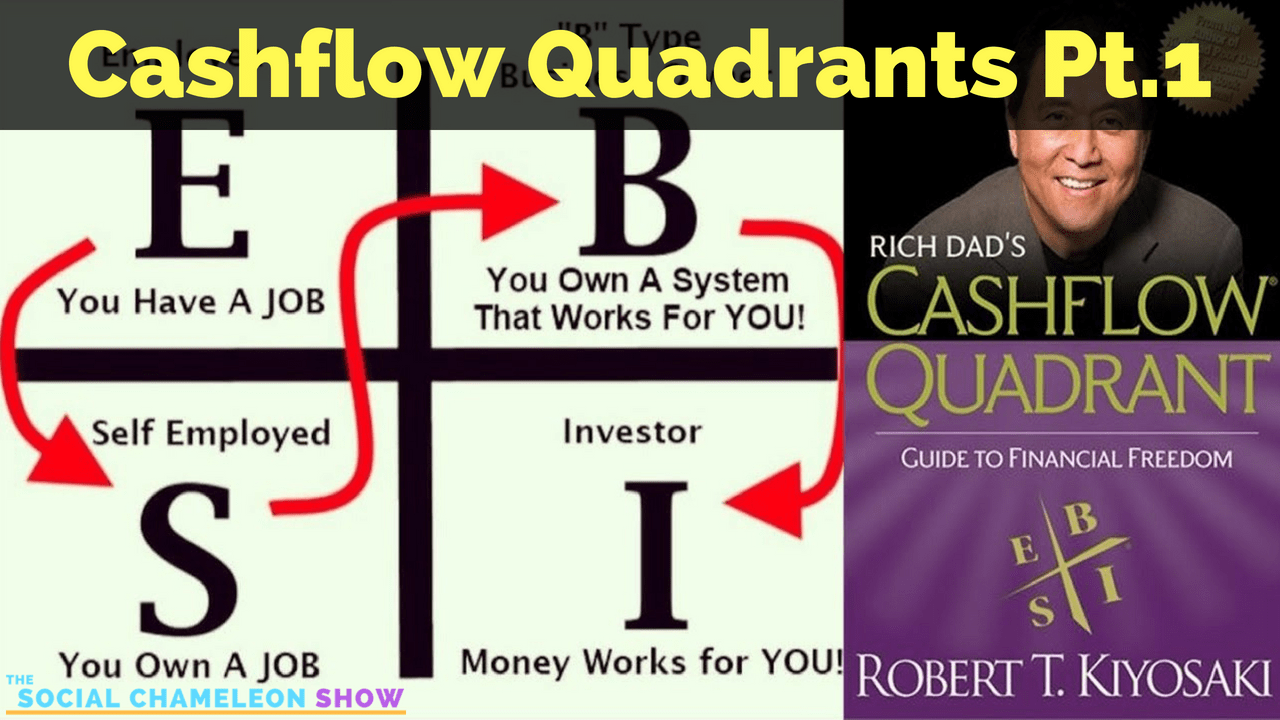

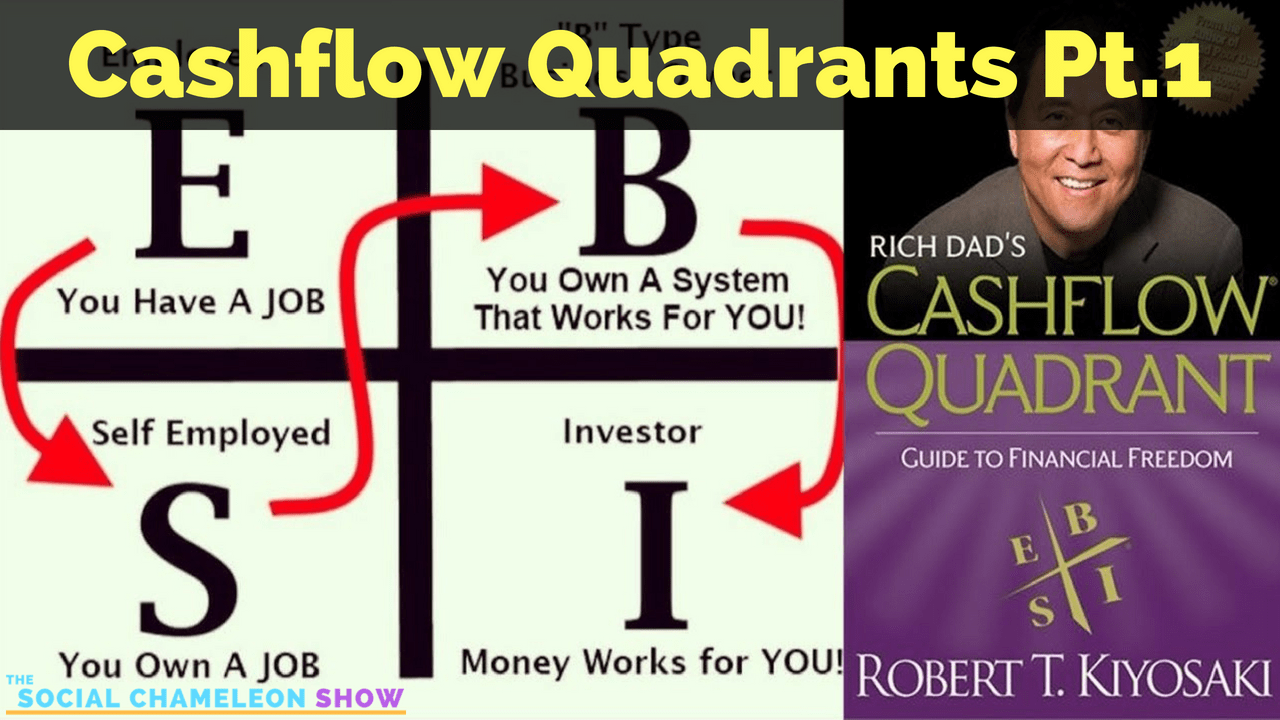

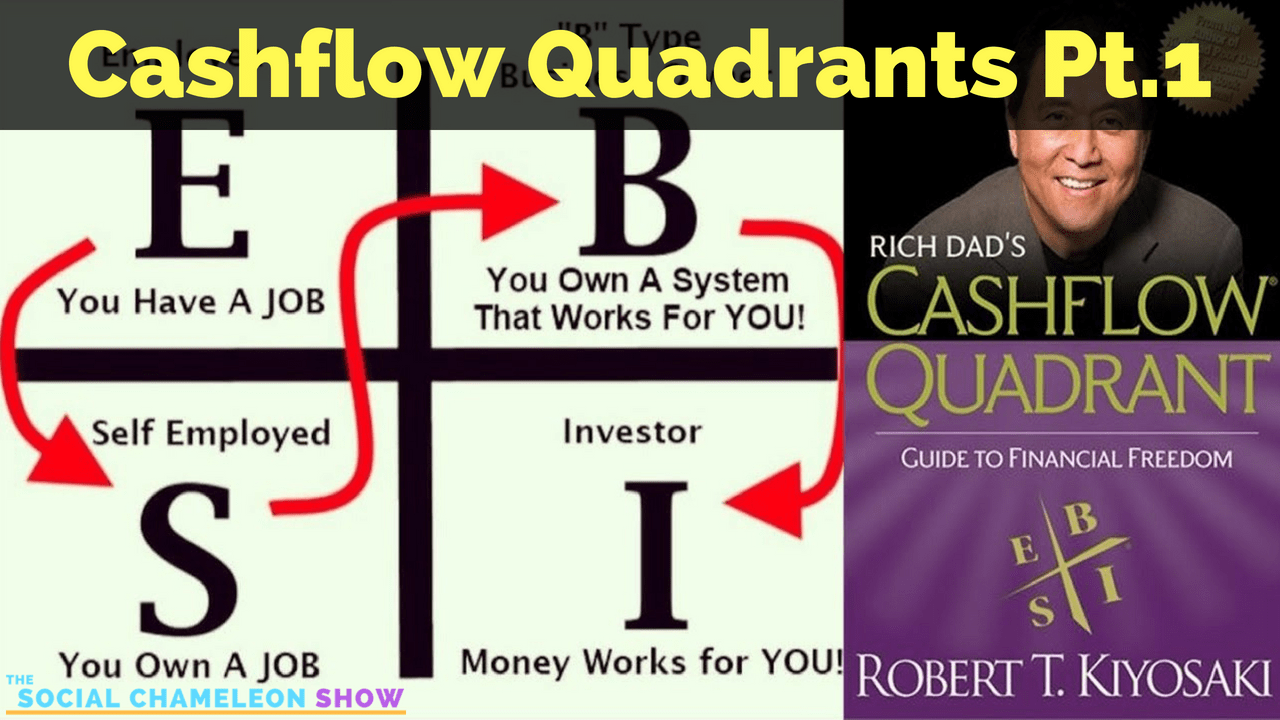

9: Cashflow Quadrants Pt 1

This week we have a special 2 part series on Income Sources know as Cashflow Quadrants. On part 1 we talk about the Left side know as the E (Employee) & S (Self-employed or Small business) Side. We discuss the definitions of each the E & S Side then go into more detail about each side giving you ideas and things to think about and implement to set yourself up for the future.

10: Cashflow Quadrants Pt 2

This week we continue our special 2 part series on Income Sources know as Cashflow Quadrants. This week we move over to the Right side know as the B (Big Business) & I (Investor) Side. We discuss the definitions of each the B & I Side, then go into more detail about each side giving you ideas and things to think about and implement to set yourself up for the future.

Episode Transcriptions

Tyson: 00:13 Welcome to the social chameleon show. Where It's our goal to help you learn, grow and transform, into the personal you want to become. Today, What you know about... Your money. This is your folks most requested topic. Here it is. Here it is for you folks to kind of end off the year on. You get something you can think about going to the next year. So we'd like to kind of start with, um, capital your, your money you're bringing in. And the first topic we'll talk about is the automagic budget, auto-magic, if i could say that correctly.

Ransom: 00:50 Oh, that's good. Well, I mean we talked about different strategies in different shows as far as doing all of it, but I think, I mean obviously it's automatic, but for this case we're going to call it auto magic because it's basically just if you don't see it, like you don't think about it. Right? And I know it's kind of hard because if you're, especially if when you throw around numbers like 10 percent, in my opinion, anybody can do 10 percent, you bring home $3,000 a month, like 300 bucks a month. You should be able to kind of put that away, right, for whatever the case might be. And once you get in the habit of not seeing that money, then you kinda get used to not having it. It's kind of like if you're an employee, you know the taxes come out of your paycheck before you actually received them. Interesting. It's kind of interesting how that works. The government is out a long time ago and they're like, yeah, just automatically take it out of their check to make sure that we. Yep. And I think it's rather interesting that most people don't do that for themselves, which is just kind of

Tyson: 02:03 got it. Got To pay yourself first. I know sometimes it's hard to even think about when you pay everybody else and then you're like, I don't got nothing left over. How am I possibly gonna pay myself without these people first. It's something you have to start to work at getting your habit. And then, um, I think like we talked about 10 percent is a good, good starting point and you can start to work up. To me, I think the ultimate goal of the stretch goal would be 20 percent of your income. Now they do 50. I've heard of. I've heard of 80, but that's all right. I think it's all right there, but if you're making a million bucks a year and your stash away, 80 percent, that's still a pretty good life, you know, so

Ransom: 02:45 yeah. Right. Twenty thousand a year, you're putting 80, 80 percent of that away. Like there's barely anything to live off there. So. Right, right, right, right.

Tyson: 02:55 And then, so we're talking about and then also trying to that five percent for investing as a starting point.

Ransom: 03:02 Uh, well I, I don't know, in my opinion, you need to save some kind of cash first. I'm definitely put some of that 10 percent away until, you know, the old man. I got to be careful how I throw that word around old like when I was growing up. Yeah. Um, they kind of had this thing about six months of income on the side just in case something happened. Uh, nowadays I don't necessarily think that that's, that's a relevant number. Number one, we have a lot more access to credit in today's world. Number two, we have stuff like unemployment and all that, you know, those kinds of things. Food stamps, right? Again, I'm not one to sit here and advocate people abuse the system. The government does have these things in place that in the event you are in a bad spot. Like, hey look, I just lost my job.

Ransom: 03:56 You know, you can collect unemployment, they'll get me wrong. Just kind of depends on where you live and how much money you make. Um, you know, here in Hawaii, I know for sure that the cap on unemployment is somewhere around $2,000 a month. So just kind of be aware of what that is. Um, and I'm, I'm not saying you don't have to save any money, but I'm just saying when I was growing up, I was told six months of your income, that's what you should put away for a rainy day in reality. And today is road. If unemployment's going to give you money, you know, then you don't necessarily need. I think three percent in savings for rainy day is probably more adequate. You can make up for the rest with either credit and slash or unemployment and in some places you can even take out, you know, the insurance like Aflac or something like that in the event that something happened. So just be aware of that. You do want to put some away for rainy day and on top of that, once that three months is put away, you'd want to start making money off what you have in there. Use your money to make money.

Tyson: 05:05 Yes. That's good. I like that. I'm going to say three to six months. I'm sticking somewhere in that range. At least three. Do you want to go to six or six? Once you've got that nest egg that the next step is to stop putting into that fund and start transferring that extra percentage into investment of some sort.

Ransom: 05:23 Right? And that whether that be, you know, again, we talked about all this, but we just want to reiterate this as another topic that's come up. So just get in there, you know, whether your or whatever type of investment strategy, create an account and maybe we can talk about that is the way that you can set these up. If your employer doesn't allow you to send a certain allotment out to whatever, go to your bank, whatever bank keep have under number one, make your employer's money under bank deposit. I know for some people I work for cash out there that may not be the best thing, may not be an option, but for the most people get direct deposit, made sure that that deposit goes directly into your account. Then go to your bank and open up a second account, name it investment account or whatever the case might be. And then have your bank automatically transfer that money into this investment account that you never see. No,

Tyson: 06:19 and that's what I do every, um, every two weeks or whatever it is I'm, I just automatically have that money just transferred from a council accounts and then just goes and spreads on its own. And in other services come in and take money from that account into their thing, on their schedule. It's so easy. Like I said, it's simple because you don't have to have the brain power, you don't necessarily have to have the discipline to be doing and put that money away because it happens regardless of your, of your behavior. And that's something that really makes it easy when you take out the human behavior element on a bit, it makes things very easy to do and you'll just get used to what's leftover in your checking account or what's available balance on your credit card, however you want to spend your money,

Ransom: 07:01 that's for sure. And you just kinda gotta imagine that just not here to say that money isn't everything, but just kind of imagine that that money is what you make it, you know, money has this purpose in life and it's, some people say it's the root of all evil. Some people don't necessarily share that opinion. Uh, I mean, I dunno, it Kinda depends on who you ask in what they're asking about. You know, money can have many faces, shapes and forms. And slash or functions that knife, what do you think about that? Tyson?

Tyson: 07:37 I like to believe money just makes you more of who you already are. A, I don't think money. Money gets a bad rap. I think it's what people see people with money doing. Um, but my money is just a tool. Money's a thing that you can use to do other things, solve problems, and make your life better. Help others. It depends on your goals and your things and just makes to me, it just makes you more of what you are. If you're already a generous person, going to be more generous. If you're greedy and self centers can be more of that story. Whatever story you've created about money that's just going to be it.

Ransom: 08:11 You know, this kind of a lot of things too about money is like some people think that, you know, if you make a lot of money, like that's a bad thing. No, that's, that's neither here nor there. Like how much money you bring into you like money. I think we talk about this right? Who's got your money? Goes around in a circle. Nobody really owns money, I say it just comes through you like the money passes from your employer and into your bank account and then from there it goes through you and then you go to the store and now the money is at the store and that store money goes to their employees which go into their bank accounts which they go and pay for other services. Like um, you kind of got to think of money as like a different thing. It gets a physical element that, I mean it is a physical element, but it's something that can pass from one area to another. It was kind of interesting

Tyson: 09:06 and it's up to you how you want money to flow to and through you. If you want it to flow to you and you want to hoard it and you want to be selfish, that's up to you. That's your, that's your story. That's your thing. But money should, in order for money to continuously flow like water, you know, you stop water, you know, eventually there's nothing on the other end. So to me, the more you let it flow through you and to you and through the next people and Maren Morris going gonna continuously flow like a nice raging river.

Ransom: 09:34 Yeah, I mean just this kind of things. I guess I've, we talk about rich that a lot because that's one of our favorite things growing up. We pay the cash flow game for those of you that have either seen it or played it, then you know what we're talking about. Those of you that haven't played it yet, I don't know. I mean I, I definitely enjoy playing it. I know it's not for everybody. Some of these principles about how to budget, um, you know, rich dad has this really good thing about an income imbalanced statement versus your assets and liabilities. She in that kind of, you know, learning those kinds of things kind of help educate you on like, you know, what's really happening with my paycheck and you know, they kind of teach you to get on the whole thing of how to get out of the rat race, which is basically instead of buying doodads, which are things that just take your money away like this new car, a new iphone x, it's coming out now. It's like Dang, I gotta have that. Like that just takes money out of your pocket. But if you can learn to invest and put money into things that are going to give money back to you, then that's the ticket. That's a way that you get out of the rat race. And those are kind of some sound principles that from that whole rich dad system. Again, we're not endorsing anything

Tyson: 10:53 very good concept. It's a good, it's a good tool. It's a good learning experience with zero impact on your real life. But with real world principles attached to it, you can have that top down view through the game and you can relate to your life like it to me, when you, when we play that game, it shows your personality, it shows the things you want to do and it shows a things where you know, whether you're risk averse or whether you enjoy the doodads or whatever, you don't want to think about it and you don't want to put the mental energy into the budget, into the longterm goals and visions like these things start to come out. And it's a game. And then in that safe environment of a, of a board game, now there's a digital version. Um, it shows you like, I gotta change my patterns. I got to change my habits. I've got to stop being scared or whatever it is, with money or with spending or with investing. It's a safe environment to learn these things, find your habits, find your tendencies, find your story around money with, with no impact on real life. But also

Ransom: 11:54 I also think it helps people take a hard look. You know, when it's a game. And you're like, you know, you get this card in life is like, oh, I'm the truck driver. Like it's easy to look at a game card or a scenario of like, oh this is the truck driver and like, you know, this is how much money he makes and it, it's easier to look at that. Versus when people look at their own bank accounts, like I don't know anybody who likes to look at their bank account, like as like, hey, let's go take a look at your bank account. Let's go over line by line item. What happened this month? I don't know. I don't think. I don't even think accountants like doing it. Like yeah, you do it and you enjoy doing. It's like, it's like Dang. Like where? Where did, where did I spend that $5,000 last month?

Ransom: 12:40 Like Oh, strip club, a Nike Nike's. I bought that a watch. I bought an pendle switch about pokemon coins. Like then you'd just go down the list of things that, that are there. And it's like if you go over them, you know, in today's world, money moves so fast that even handing cash out to people that you're already swiping your card. I know people who are already spending money on Thursday because they got that automatic deposit limit in Friday morning and it's like, okay, you know, that's the speed of money. Many people don't actually have the grasp and hold it to be like, hey, let's take a look at what we're actually spending money on and how can we improve this? How can we better upon this?

Tyson: 13:32 Yeah, it's tough. Humans have a hard time with, with thoughts out in the future and your future self and these things. But you gotta understand that's the reality of it. You're, you're, you're, you're probably going to live to be old. Most of us are lucky enough to definitely live into our fifties and sixties and beyond.

Tyson: 13:55 Right? Yeah. I'm just saying, you know, I mean, you know, things happen. Things will happen. But we, we, we live in a time where our life expectancy is definitely to the seventies. Majority of us will make it there. And when you're there, you're gonna look back and be like that. I need all them Nike's and Suck Shit. Now, you know, and it's gonna be hard. It's hard for us to look in the future and think that our brains just aren't wired that far. Twenty, 30, 40 years. And if you try. No, I have a hard time thinking like I could do a lot, I could do something with this money now or I know in the future this investment or this thing is going to pan out and I'm going to have a greater opportunity and other things. It's hard to get your mind around that and allow that to be your, you know, your, your, your kind of true north for what I'm doing today. Yes. It's going to be tough to think about in the future. I may not even live that long. Um, but there's other, other tactics too, to enjoy life that's not about wasting money and things like that. Yeah,

Ransom: 14:52 I mean, I mean definitely there's a lot of things that are out there as far as the mindset goes, you know, what you should be doing. But you know, looking, sitting there and looking at your accounts, going line by line, you know, that kind of helps you understand like what's actually going on I think. And you know, if that money's not going where you want it to go, you've got to take a look at that. You know, some people look at, they're like, oh, what does this credit card charge here? What is this credit card like have all these monthly subscriptions to all these services will actually use these services or am I just paying for the privilege of having something that I'm never going use? Yup.

Tyson: 15:33 And the classic example is people sign up for gym memberships and it's been three years since I walked into a gym, but I'm still paying 29, $95 a month because I'm thinking I'm going to go in there and I'm not, you know, and it's, it's painful to cancel. It's painful to sit there and look at it on there. There's a lot of those things that, that happened. And if it takes you a calling your credit card company and saying, I lost my credit card and please cancel it immediately for you to stop those charges and then start to think, okay, which ones do I want to give my new card? Number two, am I going to go to La Fitness? You know, maybe I should spend this $100 or I've been spending a month, I should just go and get a pull up bar and then start to get into the habit of, of, of working out before I extended for another gym membership,

Ransom: 16:18 go to the gym so that can run on a treadmill that maybe you should go run to the park or something. Right? Exactly. But any case when you start to break down these line items that I've looked at them line by line, it's like, Hey, I have this gym membership but I never go to the gym. It's like I got two choices. I can either start going to the gym or B, I can take that $100 a month and throw it into my investment account. Right? Or paying down your debt or something along those lines. Yeah, yeah. Those funds in more ways than the other. We're talking about investments, you know, basically that's it. You're looking for a return on your investment. So for the basics of investing, you have x amount of dollars, right? Let's say you have $100. Now what is the best return that you're going to get on that money?

Ransom: 17:06 You know, if you're paying $100 of interest and your credit card at 22 percent, if you pay down your credit card by a hundred bucks, that return on that investment is 22 percent, 22 percent that you don't have to pay anymore sort of thing can work both ways. You can pay down your debt or you can try to purchase something that's going to yield a higher investment later. I definitely believe in the latter of the two, which is buying an investment. That's going to be more later because if you pay down debt, yes it increases your overall income, but it doesn't give you new additional income. So kind of got to think about that. It's just, it's a little bit difficult to make that transition sometimes when you're so used to just paying down debt so that you can increase the amount of money you save every month versus switching gears into putting money into something that's going to pay you more money. Right? It was a big difference on there.

Tyson: 18:10 Yeah, you could, if you could take $100 and make a $150 a month, they took that $150 and then or that $50 gain and you've made that your credit card payment, you know, that could be something you do use, um, an additional income source to pay your debt down.

Ransom: 18:26 Yeah. And those are, those are some of the more advanced strategies that maybe we'll get into some of the later episodes and stuff. But for right now we want to focus on the basics. Number one, get those things done automatically, automatic deposit and from there, get that automatic payment. And then number two, you gotta look at the hardcore numbers and see what's actually happening with your capital and how can you change it. And then the third thing is when you have that automatic money that goes into that investment account, then you need to start putting that towards something, whether it goes to your employer's four, one k, um, I know what we're talking about. Like there's a new thing now that people automatically signed up for 401k when they get a job. Is that right?

Tyson: 19:10 Right. So what, what, what they found is, you know, like I said, humans have a hard time with these things. So what's what's been happening is companies, employers and programs or whatever it is, they're automatically opting people in to 401k. So there's a base package. So if you buy by the end of the month, if you say, if you don't say you went out, you're automatically give enrolled to this base package. And so what that's done is, um, is increased people's 401ks I think by 80 percent or something along those lines. Um, so now before what you had to do was you had to opt into a 401k. Now what they're doing is you have to opt out of a 401k. So, and then it takes a lot of stress on people. People are like, no, I don't want to deal with this, or whatever it is your story is to have.

Tyson: 19:51 I don't want to look at this. I don't want to decide on a package. I'm just going to do nothing. No, maybe I won't even live that long. I don't need this money or whatever. I'm going to win the lottery or whatever your thought is, but why not doing it, you know, that they've taken that, that, that, that friction away. And so, you know, if your company's opting you in, stay in the bed, maybe take some time on a Saturday to look at what you're opted into. Is there a better package that you'd rather be in? Go ahead and switch that out. Um, if, if your, if your company still is on an opt in basis and you need to often go to your employer opt in, I would recommend opting in at the lowest possible thing that they're matching at. So sometimes, um, it's like three percent.

Tyson: 20:33 Like if you do one or two percent, they don't match. But if you do three percent of your pay will match one for one, you know, and then, and you know, at least start there. Um, if you, you know, be better if you start at the Max, I think most plans max out at about five percent match that five percent. You're not going to, um, you're going to get used to it and you're not going to notice it. And you know, and also you can, um, a lot of companies you can take your raises, either all of it or a portion of your race and you can add that to the pot as well. And you're not really going to miss that as well.

Ransom: 21:02 Yeah. I'm not a big fan of getting rid of all your raised. I mean, if you get lazy, should enjoy at least a portion of it. Yeah, definitely don't forget about the emotional investment that you gained from getting raised and you want to be an important job and be like, Dang man, like I'm getting paid the same amount as I did last year even with this race. And I'm working harder to say know, sometimes you got to know yourself well enough to, to be like, you know, maybe I won't put all of my res away. Maybe I'll just take like maybe 80 percent or 50 percent of it and put that away and keep the rest for myself so I can also do dads or something. Then you gotta you gotTa keep your emotional side of

Tyson: 21:45 do you do. If you get five percent race, take whenever, two or three percent, put it in, add that to your investment and then take the other 50 percent and you know, pay some debt down, have a nice dinner. Whatever you want to do with it. That's a really good idea.

Ransom: 21:59 Yeah. And I think so. And then from there, you know, if you're not into the traditional things, maybe you can. Oh well I mean the traditional sense being 401k, maybe you can move on to other traditional things like buying a house. Maybe I do have a bias because I spent a little bit of time as a realtor, but you know, real estate is a slow moving investment. And over time, anybody who's bought a house 20, 30 years from now, the house is usually more than a bought it almost always. Yeah,

Tyson: 22:28 yeah, absolutely. Really good chance that you're going to make something on that in 30 years

Ransom: 22:33 investment. And if anything, you may cut down your living expenses, you know, after 30 years of living in your house and your mortgage of $700 or $5,000, zero, however vago mortgage you've got, you know, I don't know who's watching this, but that's an expense that you won't have in 30 years. They have to pay your rent in 30 years. So it's, you know, not only do you have value there, but you also have the chance to save things or if you rent it out, it could be an additional income source for you. So I like real estate slow moving thing and it has a lot of options for you. So.

Tyson: 23:11 And there's other things, um, there's a Iras, individual retirement accounts, you can open up different types of things like that. There's a, a education savings there. I mean, there's tons of things you can get an options trading account, you get a stock trading account, uh, you can learn those different things like that. They're very, very easy to set up. They take maybe a minute, two minutes, as long as you have your basic information. Maybe you got your social security number or something like that or your bank account number, but very easy to set up and open. Um,

Ransom: 23:41 let me share my screen. But, um, for those of you listening on a podcast or whatever the case, I'm just going to a Schwab.com. It's a s as in Sam, c as in Charlie, each isn't nortel, w as in Whiskey, a's and Alpha B as in Bravo, Schwab.com. And then on the other side, just go ahead and click on where do we click on the green button? Opening an account. Uh, yeah. So green button right there. Just open an account like, so easy to easy not. Yeah. And then from there it's, it's like choose your account brokerage account, retirement account, and most of you will have retirement account offered with your employer. Um, and then the state finding. Yeah. So you just choose your broker brokerage account. Then options pop up. Individual. Maybe I should, should I share? This is what I should do. I can, I can put it on the screen later and share. So for those of you looking at our screen so you can back up here.

Tyson: 24:51 I had it in the video until the 24 minute mark. Yeah,

Ransom: 24:54 you can see this, but anyway, we're just clicking this down. And then here's this orange button here that says open an account. Go ahead and open it. And so it's talking about brokerage account right here on individual account from here. Traded three times a month. Whatever you want to pick these options. Be careful what you pick and then see, look, if you don't have, if you don't know what's going on with this and you want to ask questions, there's a big chat right here, Chad. Now how do I do this? What do I sign up for? The live chat here you can. You've got a number here you can call, but you know, it's, it's, it's not, it's not rocket science. No. All of your fear about what it is that you do, like here, it takes 10 minutes to open an account with Schwab and you know, I'm just going to this first name, putting this information, then just go through the steps, click next, just keep going. Next. Like any type of fears that you have, anything that's out there, like just, just get out there, strongly encourage you to get out there. But yeah,

Tyson: 26:05 we just gotTa Start and uh, if you want to start with something, there's other things too, like I've um, I've heard of like these fractional type things where they round up your, your charged to the nearest dollar. Didn't think those few cents and they, they, um, they buy stocks or different things like that. There's lots of different things like this you can do, um, where it's on an automatic mindset against an automatic thing. I buy a cup of coffee for $5 and twenty three cents. The, the, you know, the other 70 some odd cents goes into and I buy a fractional share of apple stock, whatever it is that that's going on. Um, I've heard of a fractional bitcoins you can get with stuff like this. A, there's fractional real estate. You can buy different things. There's a lot of these little things you can do that are very simple and very automatic. There's no pain to you and they're going to really add up. Huge, huge in just a few years.

Ransom: 26:56 Yeah, for sure. So just now getting out there, these are the steps that most people take. Either start investing and slash or having their money work for them. A big part of that is up here. It's in your mind. You have to let your emotions take control and do what it is for you. Like, no, you can't. You can't have that. You got to win the war up here, right when the mine, the mine. And that goes for, like we talked about earlier, some of you may not be able to put away 10 percent, you know, it's like, Oh man, I'd love to put away 10 percent, but I only make $20,000 a year and I need every dime of that to live my life. Like if that's your real situation of that's really where you're at, then you got to go before this and be like, look, you need a new whatever or whatever that plan is, whatever that you know at, I'm not here to make fun of you or say things in that manner.

Ransom: 27:56 I'm not trying to say that you have a dead end job, but it sounds like that job is, is not serving you in the purpose that you'd like your income source or whatever your situation is like, don't get me wrong. I know the difference between being broke and the difference between having a poor mindset. Like there's a lot of people who are broke that don't necessarily have a poor mindset. They just either they're lacking options or they're lacking courage or whatever the case might be, and I'm here to tell you, man, there's Internet. Like the sky is the limit. You don't doubt yourself like number one, don't judge yourself. You've got to believe in yourself. If you're in this, you're in this place, but you can't put away 10 percent work on changing that. I don't know what it is. You gotta do you gotta you gotta get that in focus. That has to change.

Tyson: 28:46 Yeah, there's, there's, you know, there's so many things out there and if, if you got excuses about things, you can go to the library and use the Internet for free. You can go to these lobbyists classes for free. You can go on Youtube for free. You can go to almost every major university for free. There's no more excuses. If you need more money, get a race. Talk to your boss. Is your skill level. Get new skills. I'm going, you've got to go back to school, go back to school. There's, there's programs, there's grants, there's millions, millions of dollars every year. Go unused for grants, scholarships because people are too fucking lazy to apply too fucking lazy to apply themselves. Now I'll push that application also next week, some shit on Netflix I want to watch, but you're going to complain about your shitty ass life. It doesn't take that long. It doesn't take a lot of extra effort. Plus the gain in your lifestyle will be exponential. Not only you, your kids, your family, your friends, their lives will also change it just along with yours. You know there's books you can go to. Library can rent the Goddamn book for, for Re. There's no excuses. If you literally don't have two nickels to rub together, go to the library, grab a book. It's furry.

Ransom: 30:04 Yeah, and that's, you know, I, I can't advocate that enough. For every person that drive to want to change that drive to, to make things happen or that belief in concert is different and you're going to go through the struggle. The struggle is real. We've all been there and anyone who has ever accomplished anything has been there. It's just, it seems impossible now, but your, your imagination is your limitation or it's your greatest asset. Don't put limits on yourself that you don't. Most people in this world, they underestimate what they can accomplish in 10 years. Don't be like everybody else

Tyson: 30:48 and you know these things also have a lot to do with the story you have around money. It's probably what your parents went through. Maybe they struggled. Maybe they were in the Great Depression. Whatever it is that happened. Now, these are your stories. Change your story. What's wrong with your impression of money? What's wrong with your view on money? It's not real. Money is a tool. Money can do lots of things. It's your story about money. It's about making money. I come from this neighborhood, I come from this thing and I can't do that. That's bullshit. Stop that. Change your story and you'll change your life and whatever you think that's your reality. So if we understand that these limitations and borrowing, barring something physical that you can't do anything about, these are all in your mind. All your limitations are in your mind.

Ransom: 31:37 All the things that we've explained in this video of how to invest in like it's. It's not rocket science. Now we have 10 percent of your check go away to another account. That account goes into some top of investment, whether that be a house, was it a b stocks, whether that'd be retirement account and then you know, the process repeats itself. Like that's, that's as simple as it gets. It's very simple task. It's all about what you think about it and how, you know, how am I going to get myself to stop buying starbucks every morning? Am I going to get myself to, you know, maybe buy a pair of Nike's once a year instead of once a month. Um, how is it that I can explain to my friends that I'm driving a Subaru instead of a BMW? Like, you know, you kind of, you know, you gotta switch gears if you want to win the long game, always go long. You doing these short and investings, you're living

Tyson: 32:40 the fast life. That's why they call it the fast life. Easy come, easy go. But there'll be a lot of these brokerage accounts and investment accounts. Now they have free training. They buying up these trading companies and they're giving this stuff to you for free. Don't be scared. Get out there, get this stuff going. Get moving and anything else around something that we want to touch on on this? No, I think that'll be. That'll be it for this. This quick one. Let those want to remind people about your giveaways. Yeah, absolutely. Like if you've listened to episodes, there is no giveaway. We're done for the year. It's been absolutely a blast giving away. Um, we're switching gears for the holidays all through the rest of November and into December. We're doing giving back, um, the other week and my son, we went to the local grocery store and we bought 35 bags of prepackaged food that they went and delivered to the homeless people is a over to about 260 bucks in food.

Tyson: 33:37 We went and we did that donation. I really appreciate everybody that donated to that and there's more to come. We're going to keep doing. We're going to keep donating food bags as long as they have them available to bring to the homeless shelter or where I'm the whatever organization I forgot that they're working with. I'm coming up here is the next phase that I'm getting into is for the children's home here in Arizona as a children's home up here and our Mesa. I'm such an acres. They're going to be coming out with the wishlist for the, the people that are there. The children are there. I'm going to be fulfilling those. If you guys would like to help you guys can head over to the facebook page, search for holiday helper, and you'll, you can go in there, you can, you can donate if not do something in your neighborhood.

Tyson: 34:18 Do something in your community, whether it's helping a neighbor out, whether it's, you know, giving a few dollars and giving a few bit of your time. It doesn't matter. It doesn't have to be big, it's not the grand, doesn't even have to involve money. Do something for your fellow human beings and your fellow neighbors. That's what I hope to inspire you folks to do. And with that, um, for, for this episode as well in the show notes, I'm going to link to the past episodes we've done in this subject area so you guys can learn more and have more things. There's resources there, there's books there. Um, the most recent episode we did was 28, which was understanding credit. Go in there. There's tons of resources that I put together. There's books is different things. Episode Seventeen, who's got my money, where we talk about, um, well we like a more in depth.

Tyson: 35:03 We talked about earlier how the money cycles, how money works. There's tons of books and resources there for you folks. We've also done a episodes nine and 10 on the book and the concepts of cashflow quadrants. Those are two episodes or episodes. There's also a quick four minute wrap up as well as you can get a brief understanding of cashflow quadrants and how they work and where you lie and where you want to be in your life, in which quadrant you would like to be in. Go check out those. There's tons of resources in each of those episodes as well as the episode itself is a video and a podcast version for each. So whatever you guys got to do to get that information into your head, it's there for you too. There's things they're no more excuses.

Ransom: 35:45 Alright, so we've got a what's next? Challenges.

Tyson: 35:49 Yeah. Yeah. This week's challenge. Guys. Listen, sit down on a Saturday or Sunday whenever I don't give a shit what it is. Take a hard look at your, your money, where it's going, your credit card statements, your all your bills. What are you doing with it? Take a look at it. It's going to suck for most of you because you don't want to see the reality sleeping your problems under the rug. It's not going to get rid of them. Ignoring your problems is not going to get rid of them. You know? Start trying to get. Start getting to that 10 percent. Once you get your own nest egg of three to six months, choose one that works for you or somewhere in between. I don't really give a shit. Just have one of them at least three months, no more than six. Once you're done with that, start investing that money you were using and they try and get these investments to build so you can start paying down your debt and try to get to the 15 percent stretch goal. Get to the 20 percent. Look for these investments, get these things going. Stop bullshitting yourself. Stop sweeping stuff under the rug. That poems aren't going to go away. That's my challenge to get it done. We're heading into a new year. Get your life on track. Nice. Yeah.

Ransom: 36:53 Then it's always with our final thoughts. You know, this show is about awareness. You know, you gotta think about what is money to you? What should it be to me, you know, is it something that I'm scared of? Is this something that I'm throwing around freely and carelessly and not looking or not thinking about what the future holds if I continue that lifestyle, you know, or is it something that is always going to come to me? It's something that's abundant and if I learned how to manage it and use it well, it will always flow through.

Speaker 3: 37:31 No.

Ransom: 37:31 These are the things that the mind has the power to change. Anything you know, so your thoughts about money and what you believe about money. Those thoughts come true everyday. Yeah. So be mindful of what those thoughts are.

Tyson: 37:49 If you have a friend who knows somebody that needs to change your mindset and your relationship with money, sharing this with them. This is gonna. Help don't hoard this information sharing. People spread the word. You get your friend group and your family onto a new level, you know, and check out what we're doing all week long on the social media, facebook, instagram, twitter, subscribe on Youtube and your favorite podcast app. Listening pockets first, and I really encourage you folks to leave a review, good or bad, I don't care. It does help us reach more amazing people like you and for past episodes and links to everything we talked about here today. You can be social chameleon show until next time. Learning, growing, transforming. That's the person you.